Remember pay-as-you-go phone plans? Those were usage-based contracts.

It was a good way to carry a phone for cheap, only paying for the minutes you needed—that is, until you had a three-hour-long heart-to-heart with your friend that cost $500.

The same principle applies when businesses sign up for usage-based contracts.

In a usage-based agreement, the price is based on the amount of usage, rather than a fixed fee. There are pros and cons of this type of contract for both buyers and sellers.

The perks for buyers

Let’s say you’re a large manufacturer paying for software in the traditional way, with a fixed-price contract. The company pays the same amount no matter how many people use the program.

If that turns out to be unpopular software, and employees only use it a few times per month or year, the manufacturer is overpaying. Switching to a usage-based contract would let the company pay less for that particular system, likely a significant savings.

The perks for sellers

For sellers, usage-based contracts come with all kinds of upsides.

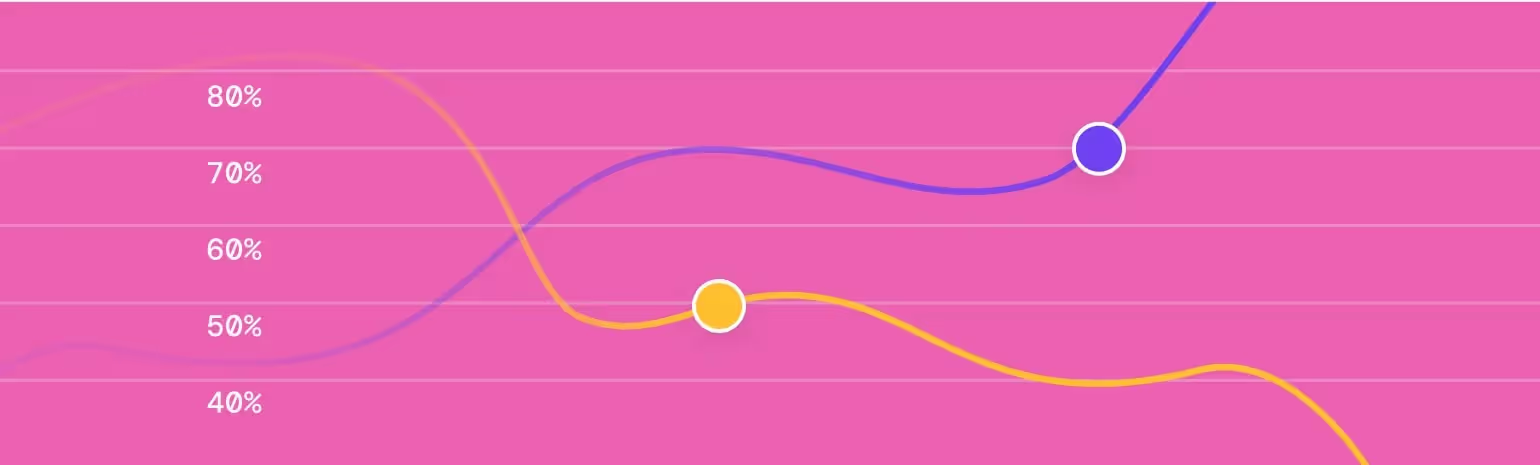

When a seller gets paid monthly based on usage, it can improve the seller’s cash flow (compared to one-time annual payments). It also generally increases flexibility. The seller can easily scale up or down resources, based on the usage trends they’re seeing. Think of a utility company that ramps up staff and equipment in hot or cold months, but scales those back when the weather is mild.

The downsides

Usage-based contracts come with plenty of risks, too.

For example, just like with phone plans, your behavior may change—sometimes for reasons beyond your control.

If your usage spikes, you end up paying way more than you expected.

During the COVID-19 pandemic, demand for digital services like healthcare surged, leaving big institutions and health-related startups with sky-high bills for services like texting.

This can also be true if you’re running a fast-growing startup that’s not careful about monitoring usage. Look away for six months, and your consumption-based cloud computing bill is thousands of dollars over budget.

Tips for negotiating a usage-based contract:

1. Make your forecasts as precise as possible.

That’s a word to the wise from Jacob Leichtman, Tropic’s Director of Procurement Services, who spent years before Tropic negotiating contracts at places like Oracle and Jet.

It’s worth spending the upfront hours—trying to anticipate how you’ll use a product, and all the possible outcomes—long before you sign any contract.

Many marketing-related services, like email outreach, outgoing text messages, and sales campaigns, work on usage-based agreements.

Yes, your usage could soar because of a once-in-a-lifetime pandemic. But it’s more likely because a product launch or rollout went better (or worse) than you anticipated. Perhaps you negotiated a contract thinking you would send out 1,000 marketing emails. But your product was very popular, so you now need 2,000.

Whatever the reason, it’s easy to blow a budget. “A usage-based contract can be a double whammy of costs,” Leichtman says. A few more hours of research ahead of time can help you avoid disasters.

2. Build in a tiered agreement.

Let’s say that—no matter how hard you try—you’re simply unsure how much you’ll be using a product or service.

Leichtman suggests building growth tiers into the supplier contract, rather than be charged for wild overages.

“It’s in a supplier’s interest to build in overages, but it’s in your interest to avoid those at all costs,” he says.

When you buy or use more of a product, that’s a good thing. It means you’re happy with the product. You should be rewarded for that, rather than penalized, and rates should go down instead of up—something you can suggest to the supplier.

For example, 1,000 emails might cost a premium, but by the time you’re sending 10,000 emails, you should see a hefty volume discount.

3. If your forecasts were off, flag it ASAP.

The good news, says Leichtman, is that many suppliers are willing to negotiate—especially if they have a lot of notice.

“Raise your hand early,” he says. “The earlier the better. You don’t want to until an annual contract comes up to say you’ve gone over a limit.”

The earlier you spot an anomaly, the more likely it is that you can still negotiate a favorable agreement.

If you're consuming more than you anticipated, you can negotiate a better rate for your additional consumption. But if you're consuming less than you anticipated, now is the time to look into early renewals at a rightsized volume—or reallocating some unused monthly minimum to other products or services.

4. Don’t be afraid to lean on suppliers.

In an unsteady economy, suppliers want to keep your business. This gives buyers an advantage. Your estimates were off and you’ve gone over your usage limit for the month or quarter?

If a supplier pushes back and threatens you with overage charges, play hardball.

“You can always say you’ll be moving your business to a competitor who has offered better rates,” says Trevor Shafer, a Group Manager on Tropic’s Commercial Executive team.

The mere implication of pulling your business can be an ace up your sleeve. Just make sure to do your homework and that you'd actually consider a switch to justify the savings. This is a strong negotiation tactic if you actually mean it, but don't say it unless you've got the research to back it up.

5. If all that fails, negotiate other terms.

Price isn’t everything, say Tropic’s negotiation pros. If you fail to come to terms with a supplier on points like price, remember that there are more aspects of the engagement with that company.

Try haggling for more favorable terms on things like the length of your contract, how you’ll be paying the bill, and the level of support you’ll receive.

Related blogs

Discover why hundreds of companies choose Tropic to gain visibility and control of their spend.