Several years ago, companies prioritized speed and growth as they rapidly expanded headcount. They quickly invested in tools that benefitted the team, product, or revenue by signing long-term agreements that increased in volume and upgraded contracts mid-cycle due to high usage and large budgets; efficiency, savings, and favorable terms were secondary.

But market conditions eventually slowed: growth stalled, budgets were reduced, spend was scrutinized, headcount was impacted, and investors clamored for profits. The result? An industry that sits on half a billion dollars worth of shelfware per year as companies stare at unused licenses and multi-year contracts with annual price hikes.

To increase leverage and gain a competitive advantage over this tide, finance and procurement teams must understand the patterns that characterize a market where dollars are tight. Let’s dive into five major procurement trends (with actionable tips to stay ahead).

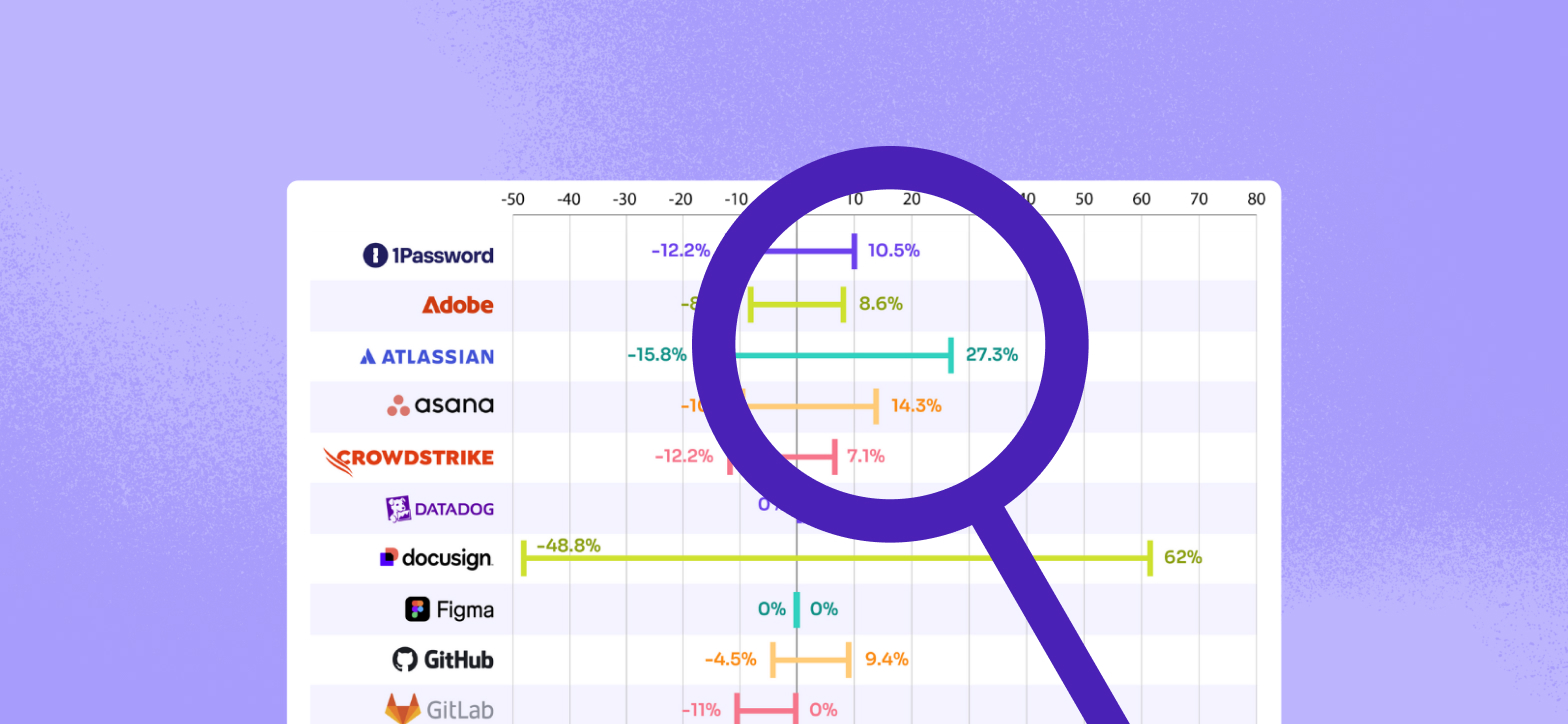

1. Aggressive supplier uplifts have increased dramatically

Suppliers are taking a more rigid and aggressive approach to increasing the price of their products as spending slows and new customers become harder to sign.

Historical uplifts of 0-3 percent have been replaced by proposed uplifts that average closer to 5-7 percent, while uplifts of 12-15 percent are not unheard of. Although portions of these uplifts can sometimes be negotiated, customers still lose leverage when reducing purchasing volume as this often results in a lower total contract cost, but a much higher per-unit cost.

Here's a tip: Engage early (at least 120 days in advance of your opt-out date) to understand what type of uplift is forecasted. This will give you more time to negotiate against that or source a new option to increase competitive leverage and potentially offset these uplifts in whole or part.

2. Willingness to consider alternatives is at an all-time high

Stakeholders are more open to exploring other solutions than they historically have been.

Given how budgets are tighter and uplifts have increased significantly, departments are figuring out how to accomplish more by spending less. As such, finance and procurement teams have prioritized sourcing to identify and evaluate alternatives. It also helps that the market is changing quickly as top suppliers expand functionality and new entrants make great strides with the help of artificial intelligence.

Investing time into this exercise can combat increasing uplifts. Whether you switch to a new supplier at a lower cost or renew with the incumbent by successfully renegotiating to keep prices as low as possible, companies find that they can counteract the 5-7 percent – sometimes 12-15 percent – proposed uplifts more frequently when they spend time sourcing. This results in meaningful budget impacts such as higher savings and smaller/fewer budget variance requests.

It’s important to note that to source effectively, you need sufficient time to analyze usage data, assess your current tech stack, understand stakeholders’ needs, and gather competitive bids. To do so, teams are engaging with stakeholders and suppliers much earlier for renewals and new purchases, often assigning resources and using market intelligence to help this effort.

Here's a tip: Consider sending a simple survey to all key stakeholders to see how open they are to exploring alternatives. This should give you a sense of their must-haves while highlighting pain points and focus areas for sourcing.

3. Rationalization is frequently on the mind of your CFO

There is a concerted effort to reduce the number of suppliers by consolidating solutions and choosing a tool that works best for business needs.

Companies realize that they don’t need the most popular tool anymore. The focus on speed and enablement in the past several years resulted in companies having multiple tools that accomplished similar outcomes and point solutions that fulfilled various, yet separate, needs.

As the market has changed, finance and procurement teams desire tools that offer the highest ROI (which often means more cost-effective). Rather than a specialized tool, buyers are prioritizing comprehensive solutions that can cover multiple needs, integrate well with other tools, offer a strong user experience, and be shared by multiple departments – especially with fewer resources available to manage and customize these tools.

Here's a tip: As approvers scrutinize renewal spend just as much as new purchases, leverage supporting data to push back from a position of knowledge and use these guiding questions to build your claim to keep, cut, or replace the tool:

- What has changed in our business that now requires this tool?

- How can you quantify the impact of buying (or not buying) this tool?

- Can we use an existing supplier in our tech stack?

- What is our max financial exposure in the next 12 months including implementation and people cost?

4. Scrutiny from finance and budget holders has increased

Several years ago, finance and budget-owner approvals seemed like rubber stamps. Now, many finance teams are implementing a zero-based budgeting strategy, which effectively requires all spend, especially software, to get re-evaluated and approved.

Note that this approval often comes at the user level, not the contractual level. This means that your approvers are tracking granular data that shows an effective and acceptable rate of utilization to determine the license count for a certain tool.

By digging into usage data, teams have realized that the spend may still be approved, but renegotiated for a limited number of licenses. In other cases, contracts may not be renewed, and the work originally provided by that tool is brought back in-house and managed through an excel spreadsheet or by a dedicated resource on your team.

With more scrutiny, buying cycles are often taking longer as approvers require more information and data. Approved spend often consists of contracts that are shorter-term, highly negotiated, and user-centric.

Here's a tip: Request deeper usage data and insights from your team or supplier to help determine how each license is used. Granular data like this will help you and your stakeholder determine an appropriate license count based on the type/level of usage, extending far beyond the traditional pass/fail perspective where companies simply allowed licenses that were being used (i.e. logged into) and removed licenses that were not.

5. Greater emphasis on accessing and using strong data to gain leverage

To level the playing field when buying software, more companies are looking to maximize efficiency while improving outcomes.

Historically, companies would appoint department resources or general procurement leaders to manage broad swathes of spend. While they were experts in the process, it required considerable time and effort to arrive at a strong outcome.

Finance and procurement teams are turning to robust tools that offer comprehensive spend intelligence like Tropic, where price benchmarking and specialized market insights are designed to help buyers know what is an ideal outcome and how to achieve it. Teams have also leveraged procurement specialists who hold extensive experience with particular suppliers.

By proactively accessing this data and expert knowledge to make fast and informed purchasing decisions, buyers realize they can eliminate the back-and-forth of negotiations and solve the lack of pricing transparency. Utilizing a strong set of market intelligence facilitates a more efficient procurement process and improves financial positioning.

Here's a tip: As you look to leverage third-party market intelligence, ensure buying partners are trustworthy by evaluating their pricing data. Not all data is created equal; many buying partners operate as pay-to-play marketplaces where they receive commissions from suppliers. This leads to skewed/biased data and insights that only compromise transparency and outcomes.

Understand the impact of procurement trends on the software buying process

Overall, buyers are pushing for contract flexibility (including short terms), conservative commitments (can always restructure later), higher ROI requirements for license utilization, and optimization of usage based agreements. These procurement trends are important for any procurement, finance, and even revenue leader to understand.

- Procurement will want to adjust their sourcing and negotiation strategies.

- Finance leaders will want pay close attention to utilization and feel empowered to leverage data to push back on new and legacy requests.

- Revenue leaders will need to adjust for longer buying cycles.

Stakeholders are open to exploring new options in this market, but will be wise to avoid long-term agreements. Teams should monitor the impact on CRPO (current remaining performance obligation) because this metric could drop as buyers shy away from lengthy commitments and ACV (annual contract value) as budgets continue to get squeezed.

Interested in learning how companies are investing in software in a belt-tightening market where resources are limited? Explore our 2023 SaaS Benchmarks Report.

Related blogs

Discover why hundreds of companies choose Tropic to gain visibility and control of their spend.