As we sat down to analyze 2024 buying trends, we knew we would see AI emerge as the key headline - so, it’s no surprise we found that OpenAI experienced a 146% YoY growth rate, followed closely by Canva and Ashby with triple digit adoption rate increases as well. But, what we think is more interesting than these numbers themselves, is what we should all do with them. As you read this year’s report, you’ll see concrete guidance from our negotiation experts on how to interpret our analysis for yourselves and how to pair it with your internal data.

Head over to read the full report for the all the insights (we won’t even make you give us an email address) or read our TLDR below for just a taste:

AI Changed Everything - Except Legacy Leaders

While Salesforce maintained its position as the most-used tool (62% of all companies), followed by Zoom, Slack and DocuSign, as we already said, AI-infrastructure and AI-native tools drove the most dramatic growth.

We also found that you can’t really be a software company without embracing AI. Our research shows that 19 of the 20 fastest-growing software companies prominently feature AI in their branding. Even companies where AI isn't the core offering now lean heavily on AI messaging.

Software Spend and Costs Keep Rising

Average software spending increased 10% in 2024. The numbers tell an interesting story about company size and efficiency:

- Enterprise companies ($21M average spend) benefit from economies of scale

- Mid-market companies spend more per employee ($14,000) than enterprises ($9,000)

- Growth-stage companies face the highest per-employee costs ($17,000)

Category Costs Tell a Story

Looking at spending by category reveals where money flows:

- IT Infrastructure leads at $748 per full-time employee

- Sales tools follow at $530 per full-time employee

- Security saw the highest price per full-time employee increases (37%)

- Design tools were the only category showing slight price decreases

Buying Patterns Vary by Company Size

Company size heavily influences software choices. Small businesses focus on collaboration tools, while enterprises invest in comprehensive systems like ERPs. However, some tools maintain consistent adoption across all segments - notably Salesforce, Zoom, and Slack.

Contract Terms Getting Longer

Companies are increasingly accepting longer contracts, with the average length now 14.2 months - up 6% from last year. This shift comes as organizations seek pricing predictability in an uncertain market.

New AI Pricing Models Emerge

Traditional per-seat pricing is giving way to usage-based models, especially for AI tools. Examples include:

- Per conversation charges

- Token-based pricing

- Success-based fees

- Usage time billing

This shift creates new challenges for forecasting and monitoring, where predictability is key.

The Rise of Automation and Efficiency

Software that helps with operational efficiency saw significant growth as companies prioritize automation over headcount. This trend spans across company sizes, showing a clear shift toward operational efficiency through technology.

Design Tools Make Their Mark

The growing importance of user experience shows in the data. Design tools like Figma and Canva dominate their sector, helping drive growth across the entire design category. This reflects a broader trend where user-friendly, design-focused tools gain market share from traditional enterprise software.

What This Means for Finance and Procurement Leaders

These trends point to several key actions for business leaders:

- Compare your software spending against industry benchmarks

- Review your contract lengths and renewal timing - always try and get price protections from the start

- Prepare for more complex pricing models, especially with AI tools

- Consider the full cost of ownership when evaluating new tools

- Start renewal discussions earlier - at least 90 days in advance

What does this all mean in 2025?

Software spending will likely continue rising in 2025, but we're seeing increased focus on consolidation. Companies that understand these trends can better position themselves for successful negotiations and strategic technology investments.

Want the complete picture? Our full report dives deeper into:

- Detailed spending benchmarks by company size

- Negotiation strategies for different tools

- Complete data on the fastest-growing tools

- Strategic recommendations for 2025

- Comprehensive analysis of AI's impact on software markets

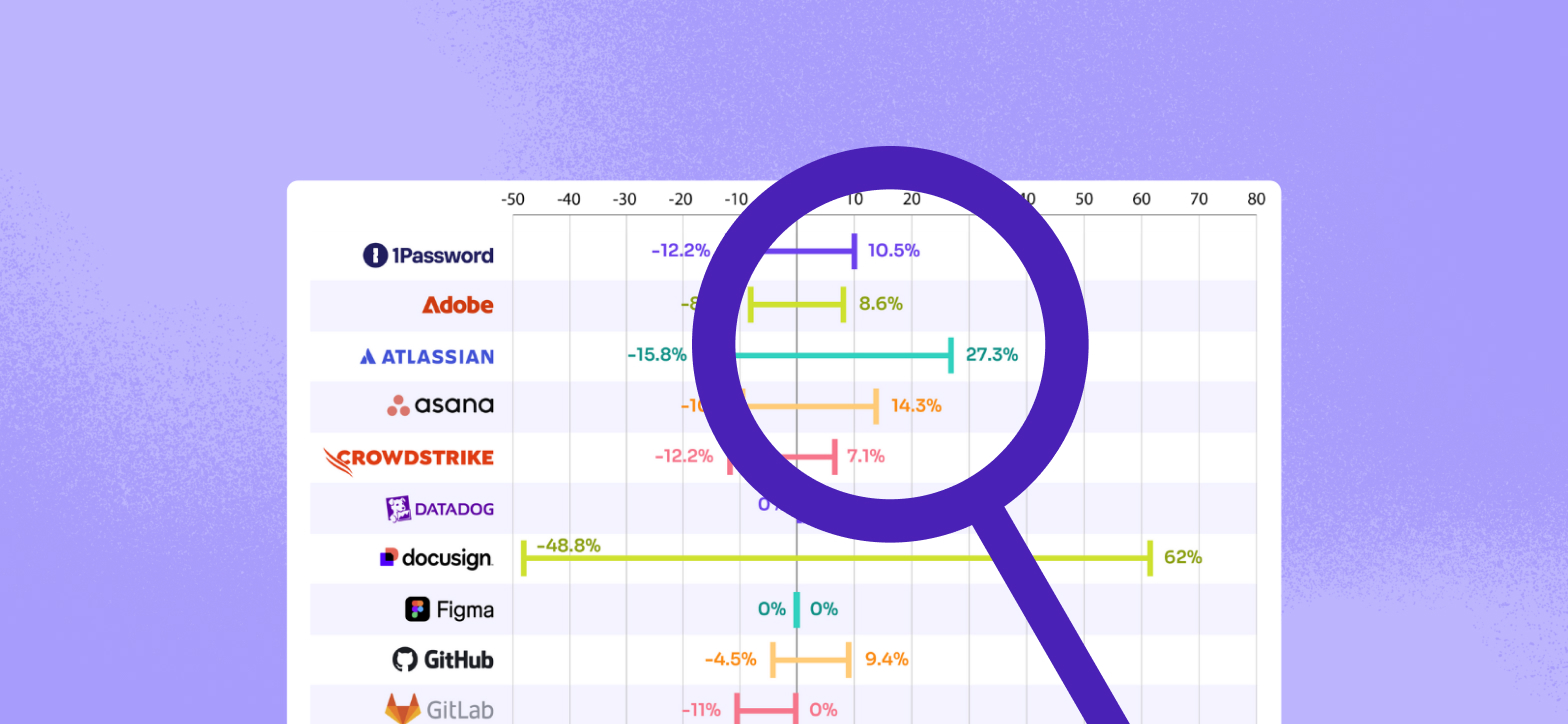

- Detailed cost per full-time employee increase data by key suppliers

Dig into the full report to get all the insights and data.

Related blogs

Discover why hundreds of companies choose Tropic to gain visibility and control of their spend.

.avif)